The taxpayer owns or uses its capital in Tennessee.The taxpayer is organized or commercially domiciled in Tennessee.Under the Act, a taxpayer has substantial nexus in the state if:

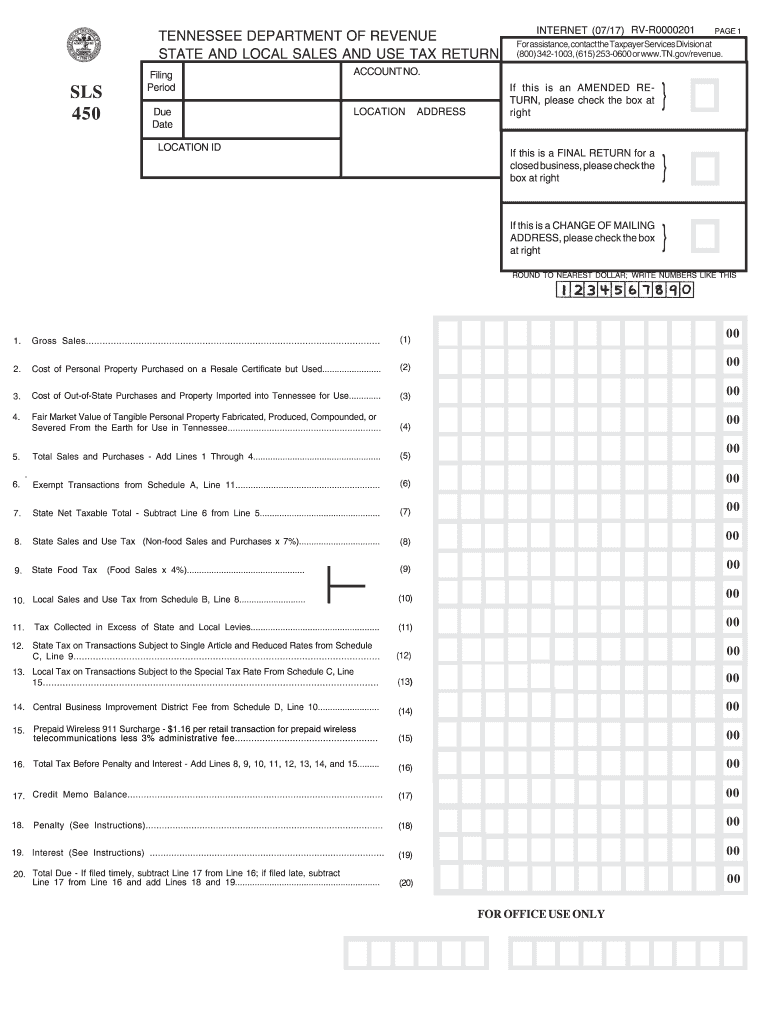

Tn salesx tax law pdf#

This tax alert summarizes these Tennessee tax law changes that have various effective dates, as specified below.įor a complete list of references, please download the PDF version of this tax alert.ĭetermining nexus and apportionment Economic nexus thresholdsĮffective for tax years beginning on or after January 1, 2016, the Act broadens the definition of “substantial nexus in this state” for both business tax and franchise and excise tax purposes and implements a “bright-line presence” threshold. Adds a presumption of “click-through” nexus for sales and use tax purposes for certain dealers.Expands sales tax to include remotely accessed software.Adds an elective apportionment calculation for high-volume sellers with distribution centers in Tennessee.Adopts market-based sourcing for sales other than the sale of tangible personal property.Amends the excise tax deduction for intangible expenses paid to an affiliate.Replaces the existing apportionment double-weighted sales factor with a triple-weighted sales factor for calculating the franchise and excise tax.Adopts economic nexus thresholds for the business tax and the franchise and excise tax.

1 The Act includes the following modifications to Tennessee law: Tennessee Governor Haslam recently signed into law the Revenue Modernization Act (the Act) (H.B.

0 kommentar(er)

0 kommentar(er)